Decentralized Finance (DeFi): Reshaping Traditional Banking

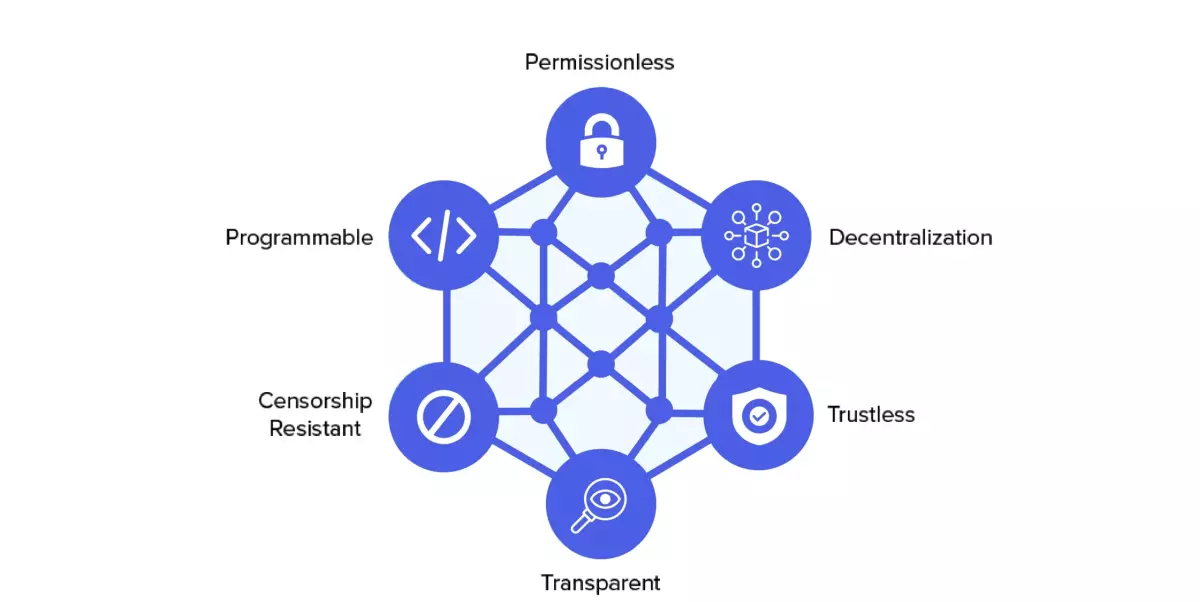

Discover how DeFi is reshaping global finance with blockchain technology.DeFi is a revolutionary approach to financial services that leverages blockchain technology to create an open, permissionless, and transparent financial ecosystem[1]. Unlike traditional finance, which relies on centralized institutions like banks and governments, DeFi operates on a peer-to-peer network, eliminating intermediaries and giving users direct control over their assets.

In my experience, explaining DeFi to newcomers is like describing the internet to someone in the 1990s - it's a paradigm shift that's hard to grasp until you've experienced it firsthand. But trust me, once you dive in, you'll wonder how you ever lived without it.

The Technology Behind DeFi

At its core, DeFi is powered by blockchain technology and smart contracts. Think of blockchain as a digital ledger that records all transactions transparently and immutably. Smart contracts, on the other hand, are self-executing agreements coded into the blockchain[2]. They're like digital vending machines - you put in the right input, and you get the desired output, all without human intervention.

DeFi vs. Traditional Finance

| Aspect | Traditional Finance | Decentralized Finance |

|---|---|---|

| Intermediaries | Banks, brokers, etc. | None (peer-to-peer) |

| Accessibility | Limited by location, credit score, etc. | Open to anyone with internet |

| Operating Hours | Business hours | 24/7 |

| Transaction Speed | Days for cross-border | Minutes or seconds |

| Transparency | Limited | Fully transparent |

| Interest Rates | Set by institutions | Determined by market forces |

Popular DeFi Applications

DeFi isn't just a concept - it's already being used in various ways:

- Lending and Borrowing: Platforms like Aave allow users to lend their crypto assets and earn interest, or borrow assets by providing collateral[3].

- Decentralized Exchanges (DEXs): Uniswap and PancakeSwap let users trade cryptocurrencies without a centralized intermediary[4].

- Yield Farming: Users can earn rewards by providing liquidity to various DeFi protocols.

- Stablecoins: Cryptocurrencies pegged to fiat currencies, offering stability in the volatile crypto market.

Potential Benefits of DeFi

The promise of DeFi extends far beyond convenience. Here are some key benefits:

- Financial Inclusion: DeFi can provide banking services to the 1.7 billion unbanked adults worldwide.

- Lower Costs: By eliminating intermediaries, DeFi can significantly reduce transaction fees.

- Higher Returns: DeFi platforms often offer higher interest rates than traditional savings accounts.

- Programmable Money: Smart contracts enable complex financial products that were previously impossible or too expensive to create.

Risks and Challenges

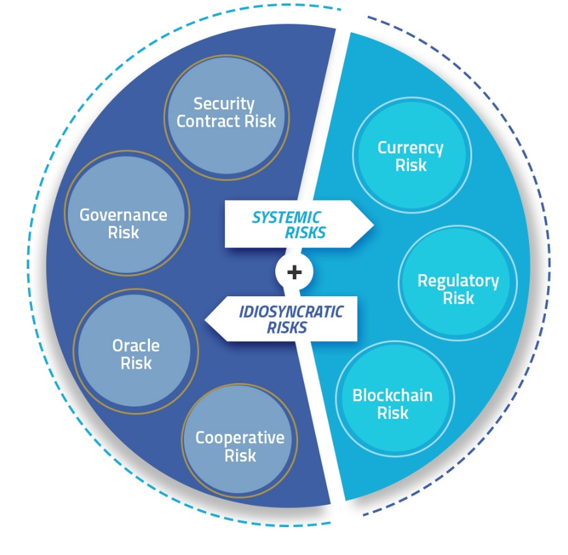

As exciting as DeFi is, it's not without risks. Smart contract vulnerabilities can lead to hacks, and the lack of regulation creates uncertainty. The volatility of cryptocurrencies also poses risks for users. As with any new technology, it's crucial to approach DeFi with caution and do your research.

Impact on Traditional Banking

Banks aren't oblivious to the DeFi revolution. Many are exploring ways to incorporate blockchain technology into their services. We might see a future where traditional and decentralized finance coexist, offering consumers the best of both worlds.

The Future of DeFi

From what I've observed, DeFi is poised for explosive growth. As the technology matures and becomes more user-friendly, we could see DeFi applications integrated into our daily lives, much like how we now use apps for everything from ordering food to hailing rides.

Getting Started with DeFi

If you're intrigued by DeFi, start by educating yourself. Set up a cryptocurrency wallet, buy some Ethereum (the backbone of most DeFi applications), and experiment with small amounts on reputable platforms. Remember, in the world of DeFi, you're your own bank - which means you're responsible for your own security.

In conclusion, DeFi represents a paradigm shift in how we think about and interact with money. It's not just a technological innovation; it's a financial revolution that has the potential to democratize access to financial services globally. While challenges remain, the potential benefits are too significant to ignore. As we stand on the brink of this new financial frontier, one thing is clear: the future of finance is decentralized, and it's coming faster than you might think.

References

- https://www.ediiie.com/blog/what-is-decentralized-finance-a-new-era-of-digital-finance/

- https://thepaymentsassociation.org/article/decentralized-finance-defi-revolutionizing-the-financial-landscape-through-blockchain-technology/

- https://www.investopedia.com/decentralized-finance-defi-5113835

- https://www.forbes.com/advisor/in/investing/cryptocurrency/defi-decentralized-finance/

- https://www.linkedin.com/pulse/decentralized-finance-defi-its-impact-traditional-banking-harry-b--mgdvf

Micro-Investing: Building Wealth One Dollar at a Time

Comments

The concept of eliminating intermediaries in financial transactions is revolutionary! DeFi is paving the way for a more transparent and fair financial system. Can’t wait to see where this goes in the next few years.

I’ve been using DeFi platforms for a few months now, and the interest rates are phenomenal compared to traditional banks. However, the security aspect still worries me a bit. Any tips on how to protect my assets?

Can someone explain how smart contracts work in layman’s terms? I get the basic idea, but the technical side is still a bit confusing for me.

DeFi is a game changer! It’s amazing to see how it’s democratizing access to financial services. The possibilities are endless, especially for those who have been underserved by traditional banking.

Leave a Comment