Gamification in Personal Finance: Turning Money Management into a Fun Adventure

Transform financial habits with gamification and enjoy managing your money.Gamification in Personal Finance: Turning Money Management into a Fun Adventure

Remember that time you found a $20 bill in your old jacket pocket? That little burst of joy you felt is exactly what gamification in personal finance aims to replicate—but on a much larger scale. As someone who's spent years exploring the intersection of behavioral economics and fintech, I've seen firsthand how turning money management into a game-like experience can transform people's financial lives. Let's dive into this exciting world where saving money becomes as addictive as crushing candies!

What is Gamification in Finance?

At its core, gamification in finance is about applying game design elements to financial tasks. It's like giving your savings account a power-up or turning your budget into a boss battle. Common elements include:

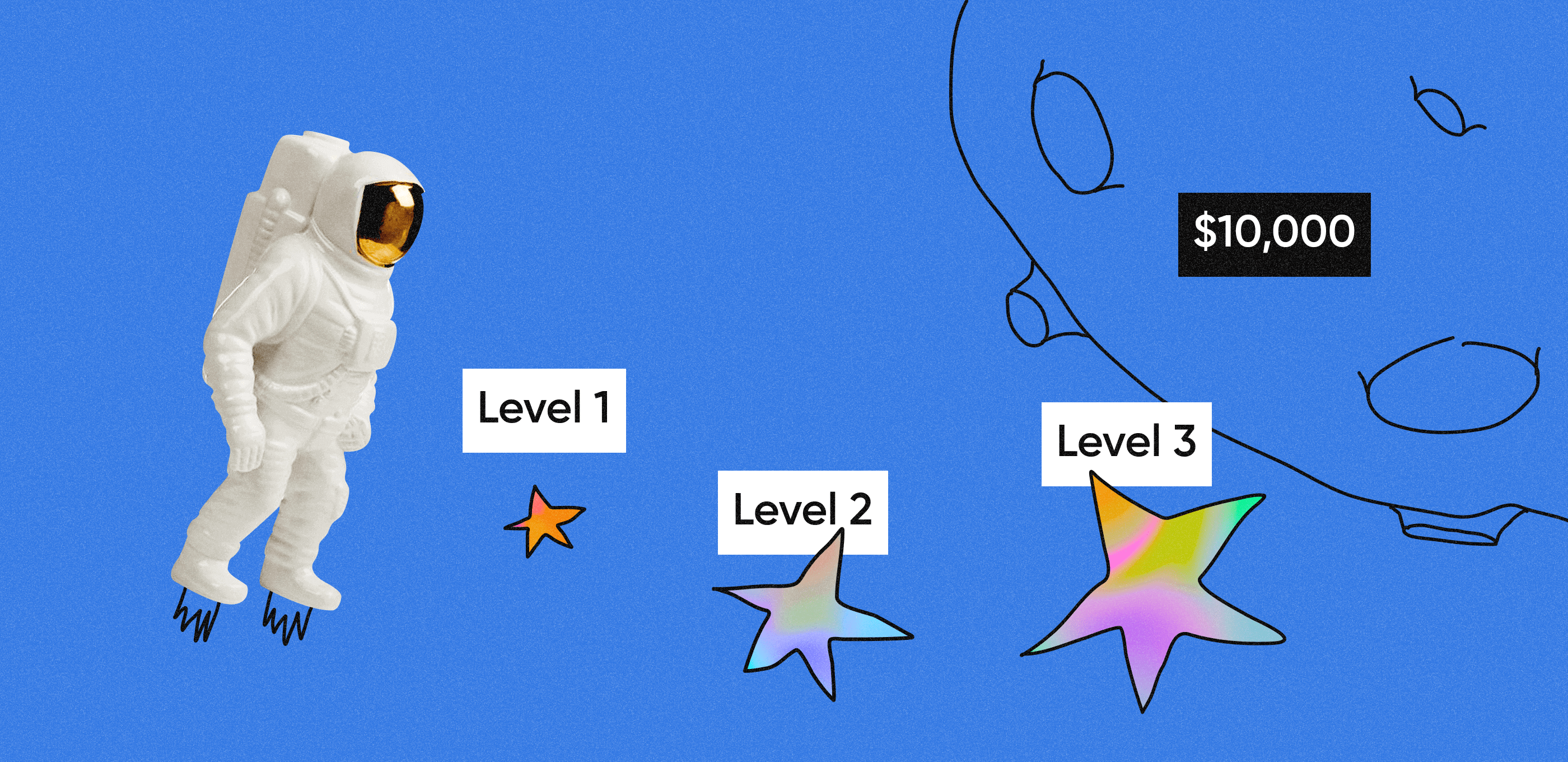

- Points and rewards for financial actions

- Levels and badges for reaching milestones

- Progress bars for tracking goals

- Challenges and quests for financial tasks

These features tap into our brain's reward system, making financial management more engaging and, dare I say, fun[1].

The Psychology Behind Financial Gamification

Ever wondered why it's so hard to put down that mobile game, but balancing your checkbook feels like pulling teeth? It's all about dopamine, my friends. Gamification triggers the same reward pathways in our brains that make video games so addictive[2].

Loss Aversion and the Endowment Effect

Two key psychological principles at play here are loss aversion and the endowment effect. We hate losing more than we love winning, and we value things more once we own them. Gamified finance apps leverage these quirks of human nature to keep us engaged. For instance, streak features in savings apps play on our fear of losing progress, motivating us to maintain good financial habits[2].

Popular Finance Apps Using Gamification

Let's level up our knowledge by looking at some apps that are nailing the gamification game:

- Acorns: This app rounds up your purchases and invests the spare change. It gamifies investing by showing your "oak tree" grow as your portfolio increases[4].

- Qapital: Users set savings rules (like the "Round-Up Rule") and earn achievements for reaching milestones. It's like turning your savings account into an RPG character[3].

- Fortune City: This unique app transforms your spending habits into a city-building game. Each purchase becomes a building in your virtual city, making expense tracking visually engaging[4].

Benefits of Gamified Finance

In my experience, gamification can work wonders for your financial health:

- Increased engagement: You're more likely to check your finances regularly when it feels like a game.

- Better habits: Rewards and streaks encourage consistent saving and smart spending.

- Financial education: Complex concepts become more digestible when presented in a game-like format.

- Accessibility: Gamification makes finance less intimidating, especially for younger users[1].

Real-Life Success Stories

I've seen some incredible transformations through gamified finance. Take Sarah, a college student who used to avoid thinking about money altogether. After starting with Qapital, she turned saving into a challenge and managed to build an emergency fund for the first time[3].

Then there's Mike, a young professional who struggled with impulsive spending. Using Fortune City helped him visualize his expenses, turning budgeting into a city-planning game. Within months, he cut his unnecessary spending by 30%[4].

Potential Drawbacks and Criticisms

Now, I'll be the first to admit that gamification isn't a silver bullet. Critics argue that it might trivialize important financial decisions or encourage a short-term focus. There's also the risk of becoming too fixated on "winning" rather than making sound long-term financial choices[2].

The Future of Gamification in Finance

Looking ahead, I'm excited about the potential integration of AR and VR in finance apps. Imagine walking through a virtual representation of your investment portfolio or competing with friends in real-time savings challenges. Traditional banks are also catching on, with many incorporating game-like elements into their mobile apps[1].

Choosing the Right Gamified Finance App

When selecting an app, consider factors like security, fees, and alignment with your financial goals. Be wary of apps that prioritize engagement over sound financial advice. Remember, the goal is to improve your finances, not just to have fun[4].

Balancing Fun and Financial Responsibility

While gamification can make finance more enjoyable, it's crucial to understand the underlying principles. Use these apps as tools to build good habits, not as substitutes for financial knowledge. In my view, the best approach combines gamified elements with solid financial education[2].

The Broader Impact on Financial Literacy

Gamification has the potential to address the financial literacy crisis by making learning about money more engaging. I've seen promising applications in schools and workplaces, where gamified financial education programs have significantly improved participants' understanding of key concepts[1].

Conclusion

Gamification in personal finance is more than just a trend—it's a powerful tool for improving financial well-being. By tapping into our natural love for games, these apps are helping people overcome financial anxiety, build better habits, and even have fun while doing it.

So, are you ready to press start on your financial game? Remember, the ultimate goal isn't just to rack up points, but to level up your real-life financial situation. Game on!

References

- https://www.purrweb.com/blog/gamification-in-banking-features-benefits-costs/

- https://smartico.ai/gamification-in-financial-management/

- https://www.finextra.com/blogposting/25083/10-best-practice-examples-of-gamification-in-financial-services

- https://www.thealien.design/insights/fintech-gamification

- https://www.openloyalty.io/insider/fintech-gamification

The Rise of Neobanks: Challenging Traditional Banking Models

Comments

Turning budgeting into a game is exactly what people like me need! It’s much easier to stay motivated when saving feels like a challenge you want to win.

I was skeptical at first, but gamified finance apps actually make managing money a lot more fun. It feels rewarding to hit financial goals when they’re set up like game levels.

Gamification in personal finance is such a clever idea! I’ve tried a couple of apps that use this approach, and it’s definitely more engaging than traditional budgeting tools.

Leave a Comment