The Future of Real Estate: How Tokenization is Revolutionizing Property Investment

Tokenization is making real estate investment accessible, liquid, and globally available.Imagine being able to invest in prime real estate in New York City, London, or Tokyo with just a few hundred dollars. Sounds too good to be true, right? Well, thanks to the magic of blockchain technology and the concept of tokenization, this scenario is quickly becoming a reality. The real estate market, long known for its high barriers to entry and illiquidity, is on the cusp of a revolutionary transformation.

The Tokenization Revolution

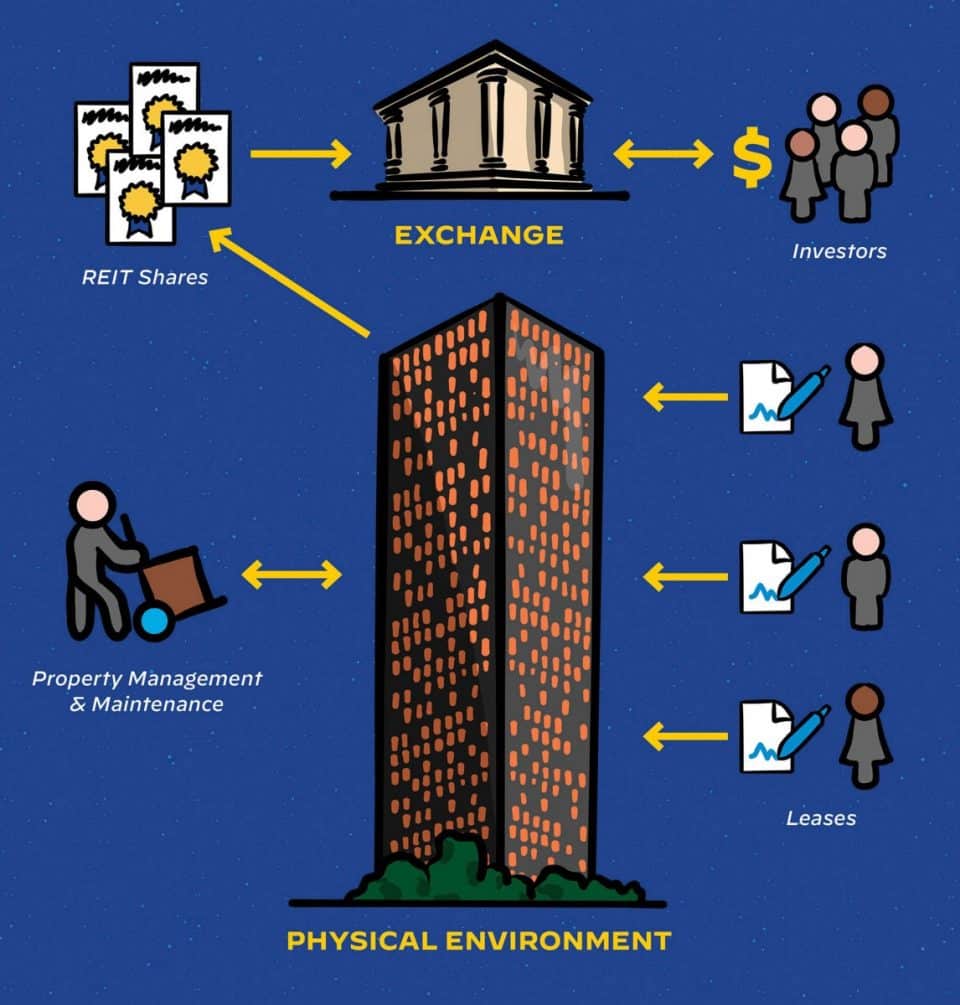

Tokenization is essentially the process of converting rights to an asset into a digital token on a blockchain. In the context of real estate, this means taking a property and dividing its ownership into digital shares that can be easily bought, sold, and traded. It's like buying stocks in a company, but instead, you're buying pieces of a building or land.

As someone who's been in the real estate game for years, I can tell you that this technology has the potential to completely upend how we think about property investment. Let me break down why this is such a big deal.

Traditional Real Estate Investing: A High-Stakes Game

For decades, real estate investing has been a playground for the wealthy. Why? Well, consider these factors:

- High capital requirements: You typically need a substantial down payment to purchase property.

- Illiquidity: Once you've invested, your money is often tied up for years.

- Geographical limitations: It's challenging to invest in markets outside your local area.

- Complexity: Real estate transactions involve a lot of paperwork, middlemen, and fees.

These barriers have kept many potential investors on the sidelines, watching as property values in desirable areas skyrocket beyond their reach.

Enter Tokenization: Democratizing Real Estate Investment

Here's where tokenization changes the game:

Fractional Ownership

Remember that New York City property I mentioned? With tokenization, it could be divided into thousands of tokens, each representing partial ownership. Suddenly, that multi-million dollar penthouse becomes accessible to a much wider range of investors.

Increased Liquidity

One of the biggest headaches in real estate is the inability to quickly sell when you need to. Tokenized properties can be traded on secondary markets, potentially 24/7, providing much-needed liquidity to the real estate market.

Global Accessibility

Living in Small Town, USA but want to invest in a booming Asian market? Tokenization makes it possible to invest in properties around the world with ease.

Transparency and Reduced Fraud

Blockchain's immutable ledger provides a clear, tamper-proof record of all transactions. This transparency can significantly reduce fraud and disputes in property transactions.

Smart Contracts and Automation

Imagine rental income automatically being distributed to token holders, or property taxes being paid without any manual intervention. Smart contracts on the blockchain can automate many processes, reducing overhead and increasing efficiency.

Real-World Success Stories

This isn't just theoretical. We're already seeing tokenization projects make waves in the real estate world:

- The St. Regis Aspen Resort: This luxury Colorado resort was tokenized through the Aspen Coin project, allowing investors to buy fractional ownership in a high-end property that would typically be out of reach for most.

- East Village in New York: A luxury apartment building in Manhattan was tokenized on the Ethereum blockchain, opening up investment opportunities in one of the world's most expensive real estate markets.

These projects are just the tip of the iceberg. As the technology matures, we're likely to see more and more properties being tokenized.

Challenges on the Horizon

Of course, no revolution comes without its challenges. The tokenization of real estate faces several hurdles:

- Regulatory Uncertainty: Many jurisdictions are still figuring out how to handle tokenized real estate from a legal standpoint.

- Technology Adoption: Both investors and real estate professionals need to get up to speed on blockchain technology.

- Market Volatility: As with any new market, there's potential for significant price swings as the sector matures.

- Security Concerns: While blockchain is secure, the platforms and wallets used to trade tokens need robust security measures to protect investors.

The Future of Property Ownership

Despite these challenges, I'm incredibly excited about the potential of tokenized real estate. We're looking at a future where:

- Property ownership becomes more accessible to a broader range of investors.

- Real estate markets become more liquid and efficient.

- Cross-border real estate investment becomes commonplace.

- Property-related processes (like rent collection or maintenance fees) become automated and transparent.

The question isn't if tokenization will change the real estate market, but how quickly and dramatically it will do so.

Getting in on the Action

If you're intrigued by the potential of tokenized real estate, there are already platforms that allow you to dip your toes in the water. Companies like RealT, USP, and SolidBlock offer tokenized real estate investment opportunities. However, as with any investment, it's crucial to do your due diligence and understand the risks involved.

In conclusion, the tokenization of real estate represents a seismic shift in how we think about property ownership and investment. It's democratizing access to one of the world's largest asset classes and has the potential to create more efficient, liquid, and transparent property markets. As we stand on the brink of this revolution, one thing is clear: the future of real estate is tokenized, and it's going to be exciting to watch it unfold.

Sources

- https://www.forbes.com/sites/digital-assets/2024/03/20/real-estate-tokenization-a-start-of-a-new-era-in-property-management/

- https://www.kaleido.io/blockchain-blog/tokenizing-real-estate

- https://www.sciencedirect.com/science/article/pii/S2772485922000606

- https://maveric-systems.com/news-events/tokenization-of-real-world-assets-on-blockchain/

- https://www.linkedin.com/pulse/how-real-estate-tokenization-changing-property-market-rock-n-block-mzlhc

Top 10 Cities For Real Estate Investment in 2024

Comments

No comments yet. Be the first to comment!

Leave a Comment