Social Impact Bonds: Investing in a Better Future

How social impact bonds align financial goals with social good.Social Impact Bonds: Investing in a Better Future

Imagine a world where investors could earn returns by funding programs that reduce homelessness, improve education outcomes, or lower recidivism rates. This isn't a utopian fantasy - it's the promise of social impact bonds (SIBs), an innovative financial instrument that's gaining traction globally.

As someone who's been studying and working with SIBs for over a decade, I've seen firsthand how they can transform the way we address complex social issues. Let me take you on a journey through the world of social impact bonds and show you why I believe they have the potential to revolutionize social finance.

What Are Social Impact Bonds?

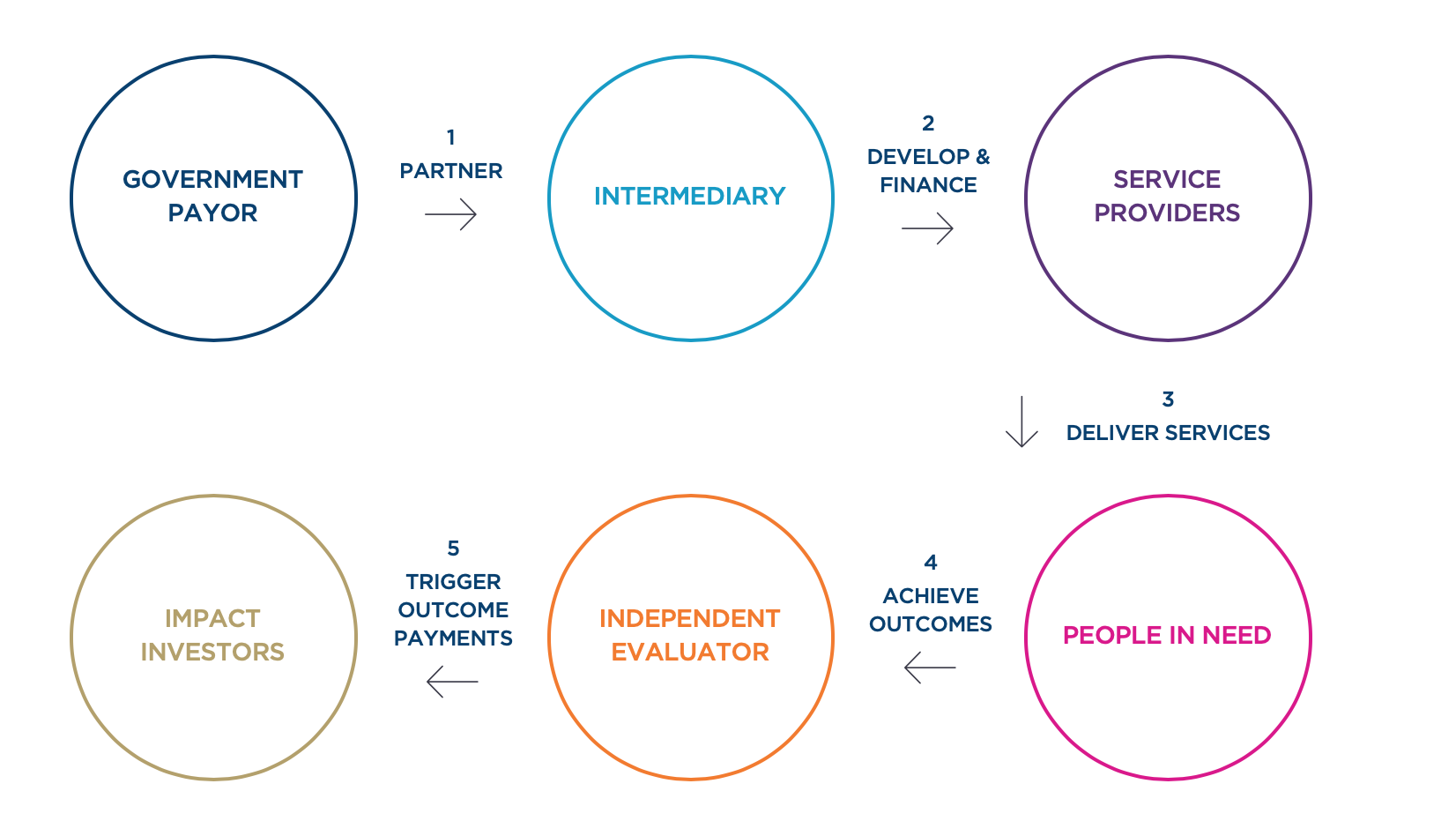

At their core, social impact bonds are a way to fund social programs with private capital, with returns tied to successful outcomes. They bring together governments, investors, and service providers in a unique partnership aimed at tackling pressing social challenges.

Here's how it works: Private investors provide upfront capital to fund a social program. If the program achieves predetermined outcomes, the government repays the investors with interest. If it doesn't, the investors may lose some or all of their investment[2].

It's like a high-stakes game of social change poker, where the jackpot is both financial returns and measurable impact on people's lives.

The Players in the SIB Game

To understand SIBs better, let's meet the key players:

- Government or outcome payer: They identify the social issue and agree to pay for successful outcomes.

- Investors: They provide the upfront capital, taking on the financial risk.

- Service providers: These are the organizations on the ground, delivering the interventions.

- Independent evaluators: They assess whether the agreed-upon outcomes have been achieved.

How Social Impact Bonds Work

Picture this: A city is struggling with high rates of homelessness. Instead of continuing to fund shelters and emergency services, they decide to try a SIB to finance a "Housing First" program.

- The city (outcome payer) sets specific targets, like "reduce chronic homelessness by 25% over 3 years."

- Investors put up $10 million to fund the program.

- A non-profit with expertise in housing support (service provider) implements the program.

- After 3 years, an independent evaluator assesses the results.

- If the targets are met, the city repays the investors their principal plus a return. If not, the investors may lose some or all of their investment.

The Promise of Social Impact Bonds

In my experience, SIBs offer several compelling advantages:

- Alignment of interests: Everyone wins when social outcomes improve.

- Focus on prevention: SIBs often fund preventative programs that can save money long-term.

- Evidence-based approach: Rigorous evaluation is built into the model.

- Risk transfer: Governments only pay for successful programs.

- Potential for innovation: Service providers have more flexibility to try new approaches.

Real-World Success Stories

Let's look at a couple of SIBs that have made a real difference:

- Peterborough Prison SIB (UK): The world's first SIB, launched in 2010, aimed to reduce recidivism among short-term prisoners. It successfully reduced reoffending by 9%, leading to repayment of investors with a 3% annual return[6].

- Educate Girls Development Impact Bond (India): This SIB focused on improving education outcomes for girls in Rajasthan. It exceeded its targets, with learning outcomes improving by 160% of the target[1].

Challenges and Criticisms

Of course, SIBs aren't a magic bullet. Critics argue that they can lead to "cherry-picking" easier-to-serve populations or oversimplifying complex social issues. There's also the challenge of accurately measuring outcomes in areas like mental health or education.

In my view, these are valid concerns, but they're not insurmountable. As the field matures, we're seeing more sophisticated approaches to measurement and a greater emphasis on serving the most vulnerable populations.

The Future of Social Impact Bonds

Looking ahead, I'm excited about the potential for SIBs to evolve and scale. We're already seeing variations like Development Impact Bonds for low and middle-income countries, and Environmental Impact Bonds tackling issues like water quality.

Technology is also playing an increasing role. I recently visited a SIB-funded program that's using AI to predict which participants are most at risk of dropping out, allowing for early intervention.

Getting Involved

If you're intrigued by SIBs, there are several ways to get involved:

- Investors can explore SIB opportunities through impact investing platforms or specialized funds.

- Service providers can reach out to local governments or SIB intermediaries to explore potential projects.

- Policymakers can learn from existing SIBs and consider piloting programs in their jurisdictions.

Conclusion

Social impact bonds represent a paradigm shift in how we address social challenges. They're not perfect, and they're not suitable for every situation. But in a world where traditional approaches often fall short, SIBs offer a promising way to align financial incentives with social good.

As the character Gordon Gekko might say if he had a change of heart: "Impact, for lack of a better word, is good." With social impact bonds, we have a chance to make that impact measurable, scalable, and financially sustainable.

The next time you hear about a social problem in your community, ask yourself: Could a social impact bond be part of the solution? The answer might just be a resounding "yes."

References

- https://golab.bsg.ox.ac.uk/knowledge-bank/case-studies/

- https://corporatefinanceinstitute.com/resources/esg/social-impact-bond/

- https://fastercapital.com/topics/examples-of-successful-social-impact-bond-projects.html

- https://www.socialfinance.org.uk/what-we-do/social-impact-bonds

- https://golab.bsg.ox.ac.uk/the-basics/social-impact-bonds/

- https://www.oecd.org/els/emp/Social_Impact_Bonds.pdf

- https://spia.princeton.edu/sites/default/files/content/Social%20Impact%20Bonds%202014%20Final%20Report.pdf

- https://www.impactinvest.org.uk/case-study/social-impact-bonds/

Fractional Investing in Luxury Assets: Democratizing High-End Markets

Comments

No comments yet. Be the first to comment!

Leave a Comment