Subscription-Based Investing: The Netflix Model for Building Wealth

Making investing as simple and accessible as a subscription service.What is Subscription-Based Investing?

Subscription-based investing platforms allow users to invest small, regular amounts of money into diversified portfolios, much like how you pay a monthly fee for unlimited access to streaming content. These platforms typically offer a range of pre-built portfolios tailored to different risk tolerances and investment goals. Users simply choose a plan, set up automatic payments, and watch their investments grow over time.

The Rise of Subscription-Based Investment Platforms

The surge in popularity of these platforms can be attributed to several factors. Fintech innovation has made it possible to create user-friendly interfaces that simplify the investing process. Additionally, younger generations, accustomed to subscription models in other aspects of their lives, are seeking similar convenience in their financial dealings.

Popular platforms like Acorns, Stash, and Robinhood have gained traction by offering unique features such as round-up investing, fractional shares, and themed portfolios. These innovations make investing more accessible and engaging for novice investors.

Benefits for Novice Investors

One of the most significant advantages of subscription-based investing is its ability to lower the barrier to entry. With some platforms allowing investments as low as $5 per month, practically anyone can start building wealth. The automated, regular investing approach also promotes good financial habits and takes advantage of dollar-cost averaging, potentially reducing the impact of market volatility over time.

Many of these platforms also include educational resources, helping users understand basic investment concepts and improve their financial literacy. It's like having a financial advisor in your pocket, guiding you through the investing journey.

Comparison with Traditional Investment Methods

Unlike traditional lump-sum investing or DIY stock picking, subscription-based investing takes a more hands-off approach. While this may not appeal to those who enjoy actively managing their portfolios, it can be a game-changer for individuals who find investing intimidating or time-consuming.

In my experience, the ease of use and "set it and forget it" nature of these platforms can lead to more consistent investing behavior. How many times have you told yourself you should invest more, only to put it off because it seemed too complicated? Subscription-based platforms remove that mental barrier.

The Psychology of Subscription Investing

From a behavioral finance perspective, subscription-based investing aligns well with our psychological tendencies. By breaking down investments into small, regular contributions, it makes the process feel less daunting. It's the financial equivalent of saying, "I can't run a marathon, but I can run a mile every day."

This model also helps overcome common investing pitfalls like emotional decision-making. When you're automatically investing a set amount each month, you're less likely to panic-sell during market downturns or make impulsive investment decisions based on headlines.

Customization and Flexibility

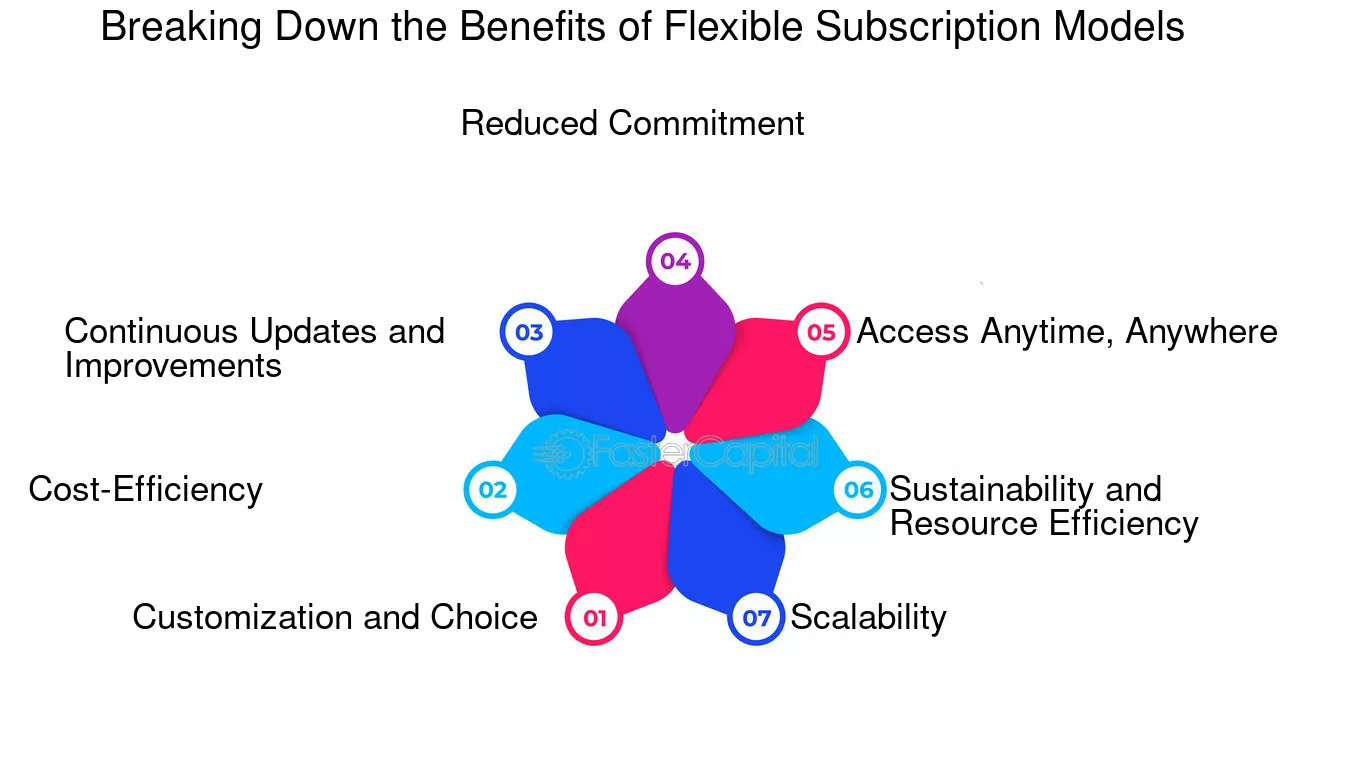

Despite their automated nature, many subscription-based platforms offer a degree of customization. Users can often adjust their risk profiles, choose between different types of portfolios (e.g., socially responsible investing options), and modify their contribution amounts based on their financial situations.

This flexibility is crucial. As someone who's used these platforms, I appreciate being able to increase my investments during months when I have extra cash, or temporarily pause contributions if unexpected expenses arise.

Fees and Costs

When it comes to fees, subscription-based platforms generally fall into two categories: those charging a flat monthly fee and those charging a percentage of assets under management. While the flat fee model can be cost-effective for smaller accounts, it's important to calculate the effective annual percentage rate as your balance grows.

Compared to traditional investment methods, these platforms can be more cost-effective for small investors. However, as your wealth grows, it's worth reassessing whether the fees remain competitive with other options.

Potential Long-Term Impact on Personal Finance

The widespread adoption of subscription-based investing could significantly change saving and investing habits. By making investing as routine as paying for Netflix, these platforms have the potential to increase the number of people actively building wealth for their future.

In the long run, this could lead to a more financially literate population and potentially help address wealth inequality by making investing more accessible to a broader range of people.

Challenges and Criticisms

While the "set it and forget it" approach is convenient, critics argue it may lead to complacency. There's a risk that users might not actively engage with their finances or adjust their strategies as their life circumstances change.

Additionally, the reliance on automated systems raises questions about what happens if these platforms face technical issues or cease operations. It's crucial for users to understand where their money is actually invested and how it's protected.

The Future of Subscription-Based Investing

Looking ahead, we can expect to see further integration of subscription-based investing with other financial services. Imagine a platform that combines investing with budgeting tools, debt management, and even cryptocurrency trading – all for one monthly fee.

As these platforms evolve, we may also see more sophisticated AI-driven personalization, offering tailored investment advice based on individual financial situations and goals.

Conclusion

Subscription-based investing has the potential to democratize wealth building in ways we've never seen before. Just as Netflix revolutionized how we consume entertainment, these platforms are changing how we approach personal finance.

As we move further into the subscription economy, it's exciting to think about how this model might reshape our financial futures. Who knows? In a few years, "Netflix and chill" might be replaced by "invest and thrill" as the coolest way to spend an evening.

Remember, while subscription-based investing offers an easy entry point into the world of finance, it's still important to educate yourself and make informed decisions. After all, building wealth is a marathon, not a sprint – but with these platforms, at least you can binge-watch your progress along the way.

References

- https://www.togai.com/blog/subscription-based-business-models-benefits-challenges/

- https://www.invoicera.com/blog/business-operations/mastering-cash-flow-in-subscription-based-businesses/

- https://conseroglobal.com/resources/how-important-is-monthly-recurring-revenue-for-investors/

- https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/subscription-based-advisory-fees

- https://www.cerillion.com/blog/the-psychology-of-subscriptions/

Social Impact Bonds: Investing in a Better Future

Comments

No comments yet. Be the first to comment!

Leave a Comment